European Apparel Market Report Summary

The European apparel market size was valued at EUR 482 billion in 2022. The market is expected to grow at a CAGR of over 3% from 2022 to 2027. Factors such as advancements in online distribution channels in emerging Eastern European markets, consumer preferences for convenience, and improved online proposition of brands are expected to drive the growth of the European apparel market over the coming years.

European Apparel Market Outlook 2022-2027 (EUR billion)

To get more information on the forecast European apparel market, purchase the full report.

Download a free sample report

The European Apparel Market report provides data illustrating market and sector trends in terms of value and volume. It also reveals brand leaders in each category and the overall European apparel market in terms of market share for 2022. This European Apparel Market research report provides historical and forecast period data for total apparel sales in Europe. The report provides a detailed analysis of the market along with the impact of recent events on customer shopping behavior, major apparel retailers, and the sector.

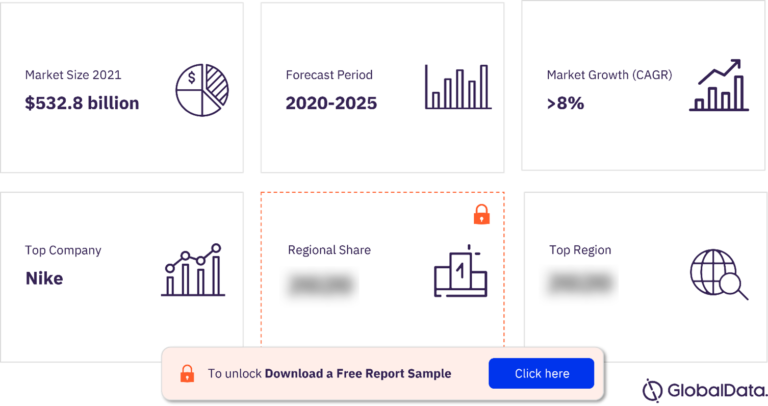

Market size (2022): 482 billion euros CAGR (2022-2027): >3% Forecast period: 2023-2027 Actual period: 2017-2022 Main categories: Clothing

· accessories

Footwear

Main distribution channels: Specialists in clothing, footwear and accessories

Online Specialist

· Department store

Hypermarkets, supermarkets, hard discount stores

Major Brands: Nike

Zara

H&M

Adidas

Primark

Contact Us and Decide Find the best solution for your business needs. Contact us now and let us help you make an informed decision before you buy.

A driving force in the European apparel market

The key factors influencing the European apparel market are the surge in digital transformation, the resilience of luxury goods, and the sustained demand for athleisure. Advancements in digital platforms have made them a viable option for consumers seeking wider choice and convenience. Moreover, Europe is considered to be an important global destination for luxury shopping, drawing tourists to the continent from across the world. Renowned luxury fashion brands such as Hermes, Dior, Louis Vuitton, and Chanel from Italy and France will leverage their luxury heritage during the forecast period. The demand for athleisure will remain high in the European market due to its comfort and versatility. To capitalize on this high demand, brands such as H&M and ASOS are expanding their sportswear lineups, broadening consumer choices.

To get more information on the drivers of the European apparel market, purchase the full report.

Download a free sample report

Segmentation of the European Apparel Market by Category

The main categories of the European apparel market are clothing, accessories, and footwear. Women’s clothing, men’s clothing, and children’s clothing are the main subcategories of the clothing category. Women’s clothing sales in Europe increased in 2022 due to increased purchases by women.

Based on product segment, the skirts and swimwear segment is expected to achieve the highest CAGR between 2022 and 2027. Skirts were one of the most affected segments during the pandemic due to the rise in casual wear. However, swimwear has experienced a strong recovery in 2022 and 2023 as international holidays resume, and consumers will continue to prioritize swimwear in the coming years.

European Apparel Market Analysis (by Category), 2022 (%)

To get more detailed information on the European apparel market category, purchase the full report.

Download a free sample report

Segmentation of the European apparel market by distribution channel

Specialized stores selling clothing, footwear and accessories were the leading distribution channel for the European apparel market in 2022.

The main distribution channels for the European apparel market are specialized clothing, footwear and accessories stores, online specialized stores, department stores, hypermarkets, supermarkets, hard discounters, etc. In 2022, specialized clothing, footwear and accessories stores captured the largest share of the European apparel market. Specialized clothing and footwear stores will drive a shift in spending from stores to digital channels due to the growing popularity of online sales. In addition to increasing their online presence, brands such as Zara and H&M are incorporating digital technology into their brick-and-mortar stores to increase engagement and provide consumers with a seamless shopping experience.

Analysis of the European Apparel Market in 2022 (by Distribution Channel) (%)

To get more information on distribution channels in the European apparel market, purchase the full report.

Download a free sample report

European Apparel Market – Competitive Landscape

The major brands in the European apparel market are:

Nike Zara H&M Adidas Primark

In 2022, Nike led the European apparel market. Zara overtook H&M in 2023 to become the second largest apparel brand in Europe after Nike. Despite inflationary pressures, Zara’s impeccable design and broad appeal to a wide range of age groups led to an increase in global sales in 2023. Other companies such as Shein and Primark emerged as winners in 2023 due to their appropriate prices and attractive product offerings.

European Apparel Market Analysis by Brand, 2022 (%)

To get more information on brands in the European apparel market, purchase the full report.

Download a free sample report

Key Segments Covered in the European Apparel Market Report

European Apparel Category Outlook (Value, Billion Euros, 2017-2027)

Clothing Accessories Footwear

European Apparel Distribution Channel Outlook (Value, Billion Euros, 2017-2027)

Clothing, footwear and accessories specialty stores Online specialty stores Department stores Hypermarkets, supermarkets and discount stores

Key highlights

The European apparel market is expected to grow at a CAGR of 3.6% between 2022 and 2027, reaching €576.3 billion.

As Eastern Europe develops and consumers demand more choices, online penetration will continue to grow.

Zara is set to overtake H&M to become Europe’s second-largest apparel brand in 2023 and could overtake top-ranked Nike in 2024.

Reasons to buy

Gain a comprehensive understanding of the European Apparel market and forecasts to 2027. Influenced by recent events in the European Apparel market, explore new opportunities where you can adjust your product offerings and strategies to meet demand. Examine current trends and forecasts for European Apparel to identify the most likely opportunities. Understand the main competitors in this sector and their prices.

Source link